Overview

Documents Required

FAQs

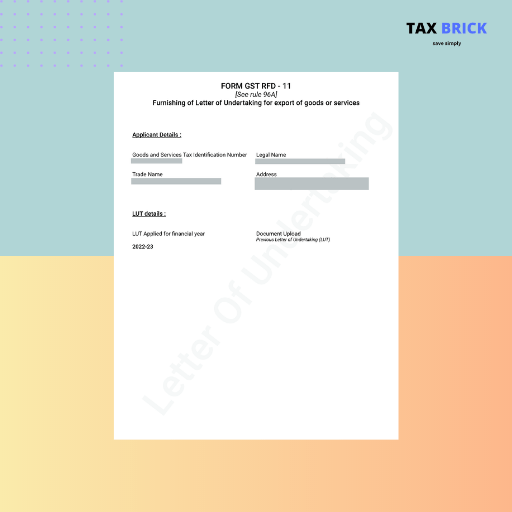

What is a GST LUT?

A GST LUT or Letter of Undertaking is a document that allows exporters to export goods or services without payment of IGST. It is a declaration that the exporter will fulfill all the conditions and requirements for availing the benefit of export without payment of IGST.

Who can apply for a GST LUT?

Any registered exporter who has fulfilled the criteria for export of goods or services without payment of IGST can apply for a GST LUT.

What is the validity period of a GST LUT?

The validity period of a GST LUT is generally one financial year (April to March). However, it can be extended for another year if the exporter fulfills the conditions and requirements for availing the benefit of export without payment of IGST.

Is a bank guarantee required for GST LUT filing?

Yes, a bank guarantee or bond equivalent to the amount of tax payable on the export of goods or services without payment of IGST is required for GST LUT filing.

Is it mandatory to file a GST LUT every year?

Yes, it is mandatory to file a GST LUT every year if the exporter wishes to export goods or services without payment of IGST.

Can a GST LUT be revoked?

Yes, a GST LUT can be revoked if the exporter fails to fulfill the conditions and requirements for availing the benefit of export without payment of IGST. The exporter will then have to pay the IGST on exports and file a refund claim.

Can a GST LUT be filed after the due date?

Yes, a GST LUT can be filed after the due date, subject to payment of late fees as applicable. However, it is advisable to file the LUT within the due date to avoid any penalties or delays in exports.

Can a GST LUT be filed online?

Yes, a GST LUT can be filed online on the GST portal by logging in with the registered credentials and navigating to the relevant form. The LUT should be submitted electronically using a digital signature or electronic verification code.

What is the procedure for obtaining a bank guarantee or bond for GST LUT filing?

The exporter needs to approach the bank or financial institution and submit the required documents to obtain a bank guarantee or bond as per the format specified by the GST department. The bank or financial institution may charge a fee for issuing the guarantee or bond.

Can a GST LUT be filed for services only?

Yes, a GST LUT can be filed for services only, subject to fulfillment of the criteria and conditions for availing the benefit of export without payment of IGST.

Can a GST LUT be filed for supply to SEZs (Special Economic Zones)?

Yes, a GST LUT can be filed for supply of goods or services to SEZs without payment of IGST, subject to fulfillment of the conditions and requirements specified by the GST department.

Can a GST LUT be filed for export of exempted goods or services?

No, a GST LUT cannot be filed for export of exempted goods or services. Only taxable goods or services can be exported without payment of IGST using a GST LUT.

What is the consequence of non-compliance with GST LUT conditions?

If an exporter fails to fulfill the conditions and requirements for availing the benefit of export without payment of IGST, the GST department may revoke the LUT and require the exporter to pay the IGST on exports. The exporter will then have to file a refund claim to get back the IGST paid. In addition, the exporter may also be liable for penalties and interest.

Can a GST LUT be cancelled before the end of the financial year?

Yes, a GST LUT can be cancelled before the end of the financial year by filing an application for cancellation on the GST portal. However, the exporter will have to pay the IGST on exports and file a refund claim for exports made after the cancellation of the LUT.